Health insurance during and following COVID-19

How health insurance changes due to COVID-19 may affect you.

The COVID-19 pandemic has caused many of us to take a closer look at our health insurance needs and to try to figure out whether our current coverage adequately meets those needs. If you find yourself evaluating your health plan, know that there have been health insurance changes due to COVID-19.

Coverage for COVID-19 testing and vaccines

If you need care as the result of contracting COVID-19, special rules may affect what you are responsible for covering. In March of 2020, Congress passed the CARES Act, which eliminated the cost sharing of some services such as testing and vaccines. Under the law, insurance companies must generally cover the cost of testing — meaning you pay nothing. Vaccines, too, must be provided free of charge. And if you don't have insurance, you can receive COVID-19 care for free if your provider bills the government.

Have you lost health insurance coverage because of a job loss?

The COBRA law allows you to continue on your former employer's plan for up to 18 months (provided you cover the full premium). You may also meet requirements for Medicaid, and if you have children, they could qualify for the Children's Health Insurance Program (CHIP).

Additionally, affordable health insurance coverage is available through the health insurance marketplace, and financial assistance to subsidize monthly premiums may be available to those who qualify.

Assess your health insurance coverage

To make sure your health care needs are met, take a close look at how much coverage your plan would provide if you get sick with COVID-19. If you need to make changes, you can start in November during the open enrollment period when you are eligible to make changes to your health care.

If you've lost coverage, here's what you need to know.

LOST COVERAGE

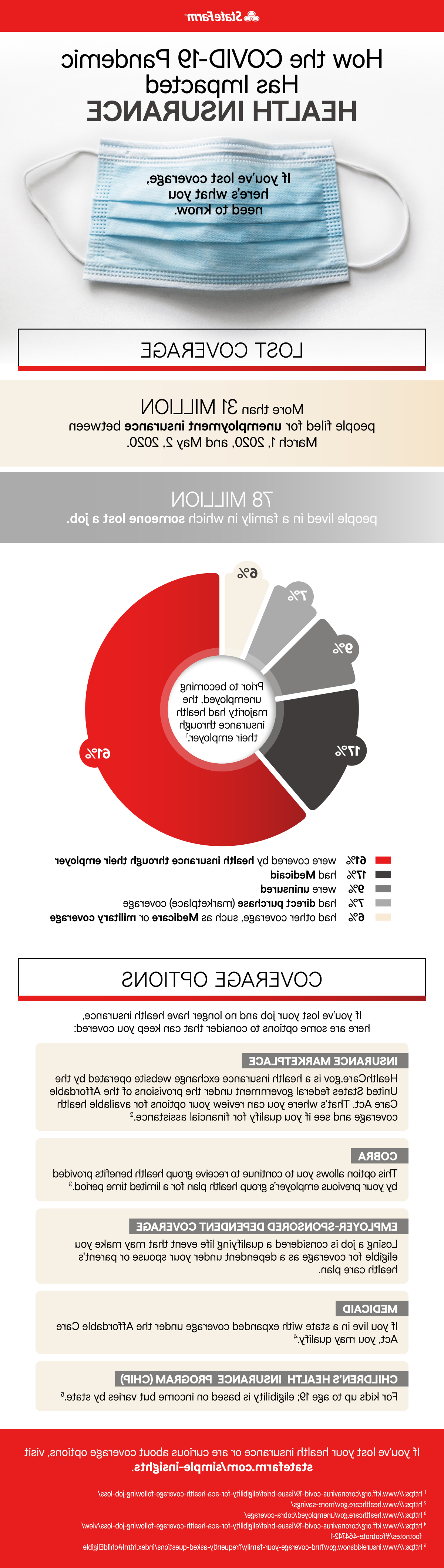

More than 31 MILLION people filed for unemployment insurance between March 1, 2020, and May 2, 2020.

78 MILLION people lived in a family in which someone lost a job.

Prior to becoming unemployed, the majority had health insurance through their employer.1

- 61% were covered by health insurance through their employer

- 17% had Medicaid

- 9% were uninsured

- 7% had direct purchase (marketplace) coverage

- 6% had other coverage, such as Medicare or military coverage

COVERAGE OPTIONS

If you've lost your job and no longer have health insurance, here are some options to consider that can keep you covered:

INSURANCE MARKETPLACE

- HealthCare.gov is a health insurance exchange website operated under the United States federal government by the provisions of the Affordable Care Act. That's where you can review your options for available health coverage and see if you qualify for financial assistance.2

COBRA

- This option allows you to continue to receive group health benefits provided by your previous employer's group health plan for a limited time period.3

EMPLOYER-SPONSORED DEPENDENT COVERAGE

- Losing a job is considered a qualifying life event that may make you eligible for coverage as a dependent under your spouse or parent's health care plan.

MEDICAID

- If you live in a state with expanded coverage under the Affordable Care Act, you may qualify.4

CHILDREN'S HEALTH INSURANCE PROGRAM (CHIP)

- For kids up to age 19; eligibility is based on income but varies by state.5

If you've lost your health insurance or are curious about coverage options, visit 36837a.com/simple-insights.

1 http://www.kff.org/coronavirus-covid-19/issue-brief/eligibility-for-aca-health-coverage-following-job-loss/

2 http://www.healthcare.gov/more-savings/

3 http://www.healthcare.gov/unemployed/cobra-coverage/

4 http://www.kff.org/coronavirus-covid-19/issue-brief/eligibility-for-aca-health-coverage-following-job-loss/view/footnotes/#footnote-464742-1

5 http://www.insurekidsnow.gov/find-coverage-your-family/frequently-asked-questions/index.html#childEligible